The heart of any business, accounting is a critical field with boundless opportunities. Preparing for an accounting interview requires more than just textbook knowledge. It’s about showcasing your understanding of core concepts, problem-solving skills, and ability to communicate your expertise clearly. To ace your interview, you need to be ready for a wide range of questions that go beyond the theoretical. This blog post serves as your roadmap to acing that interview, offering a curated selection of basic accounting questions and answers you can practice. We’ll delve into the core concepts, explore the questions likely to be posed, and equip you with practical tips to navigate the interview process confidently.

Image: www.slideshare.net

Understanding the Basics

Accounting, at its heart, is the language of business. It’s how companies track their financial performance, make informed decisions, and ensure financial health. Mastering the basics is crucial, and understanding these fundamentals will allow you to confidently answer a wide range of interview questions.

Let’s break down the core concepts you need to understand:

Financial Statements

The foundation of accounting lies in the ability to interpret financial statements – the language through which businesses communicate their financial performance. The three primary financial statements, each with its distinct purpose, are:

- Balance Sheet: This snapshot of a company’s financial position at a specific point in time reveals its assets, liabilities, and equity.

- Income Statement: The income statement presents a company’s revenue and expenses over a specific period, highlighting its profitability.

- Statement of Cash Flows: This statement reveals the movement of cash within a company over a period, showcasing how cash is generated and used.

Key Accounting Principles

Accounting principles are the guidelines used to ensure consistency and transparency in financial reporting. Understanding these principles is crucial, as they inform how transactions are recorded and presented. Some critical accounting principles include:

- Accrual Accounting: This principle recognizes revenue and expenses when they are earned or incurred, not necessarily when cash is exchanged.

- Matching Principle: This principle requires expenses to be matched with the revenue they generate in the same accounting period.

- Going Concern Principle: This assumption guides the accounting process, presuming that a business will operate indefinitely unless there is evidence to the contrary.

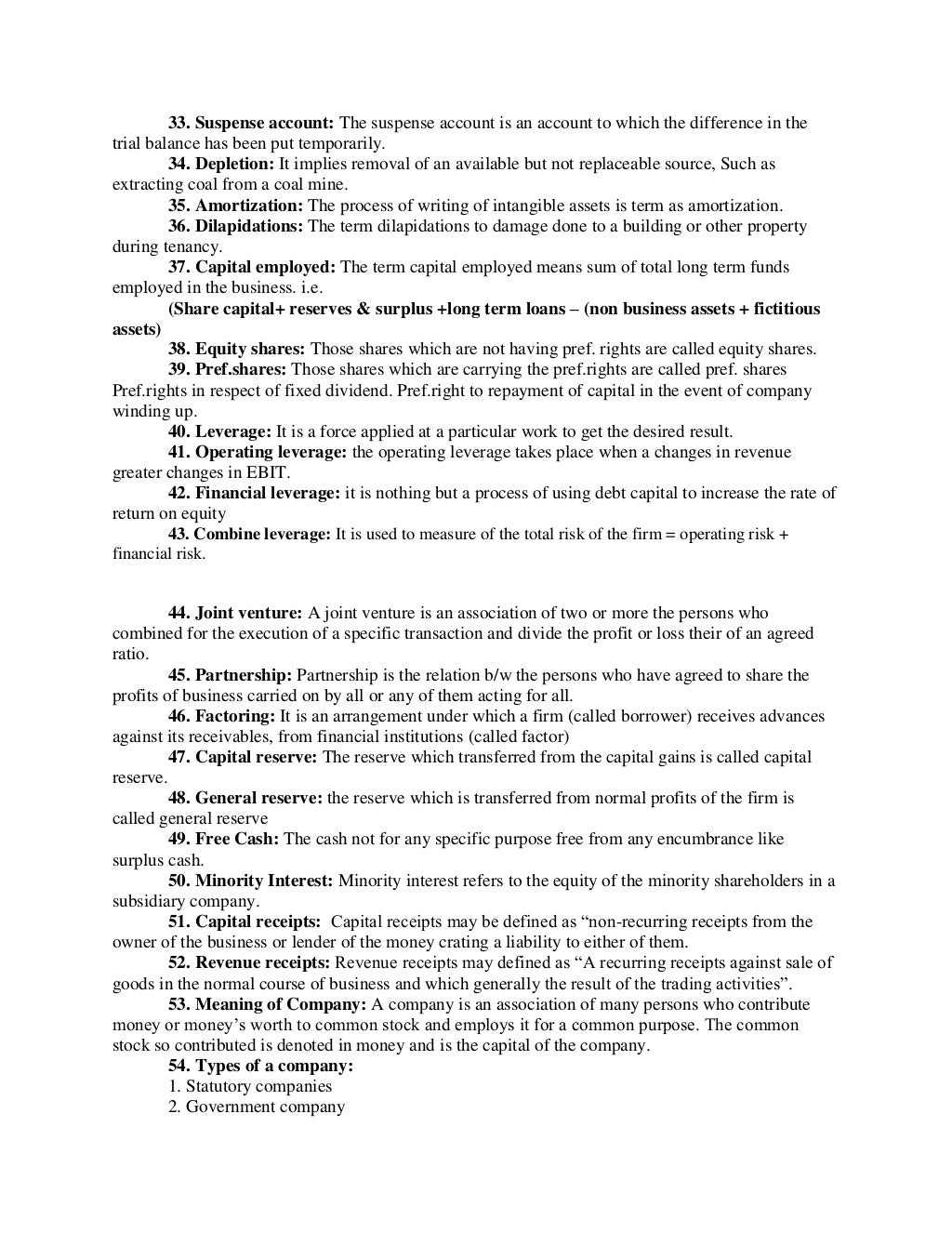

Image: www.slideshare.net

Accounting Ratios

Accounting ratios are powerful tools used to assess a company’s financial performance and health. They provide insights into profitability, liquidity, solvency, and efficiency. Understanding these ratios will demonstrate your analytical skills and ability to interpret financial data. Key ratios include:

- Profitability Ratios: These ratios, such as gross profit margin and return on equity, measure a company’s ability to generate profits.

- Liquidity Ratios: Ratios like the current ratio and quick ratio assess a company’s ability to meet short-term financial obligations.

- Solvency Ratios: Ratios such as the debt-to-equity ratio and times interest earned indicate a company’s ability to meet its long-term financial obligations.

Common Accounting Software

The modern accounting world is heavily reliant on software to streamline tasks and automate processes. While the specific software programs may differ between companies, understanding the basics of commonly used platforms is essential. Some popular accounting software includes:

- QuickBooks: A popular choice for small to medium-sized businesses, QuickBooks offers comprehensive accounting features and integrates with various business applications.

- Xero: This cloud-based accounting software is designed for small businesses, offering features like invoicing, bank reconciliation, and expense tracking.

- Sage Intacct: Sage Intacct is a cloud-based accounting solution aimed at mid-sized businesses, providing comprehensive financial management capabilities.

Basic Accounting Interview Questions and Answers

Now that we’ve covered the essential basics, it’s time to delve into the specific questions you may encounter during your accounting interview. Here are some common questions and insightful answers to help you prepare:

1. What are the main types of financial statements?

This question tests your basic understanding of financial reporting.

Answer: “The three main types of financial statements are the balance sheet, the income statement, and the statement of cash flows. The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. The income statement presents the company’s revenues and expenses over a period, ultimately showing its profitability. The statement of cash flows tracks the movement of cash into and out of the company over a period, illustrating how cash is generated and utilized.”

2. What is the accounting equation?

This fundamental concept is often tested through interview questions.

Answer: “The accounting equation is the core principle of double-entry bookkeeping. Assets = Liabilities + Equity. This equation expresses the fact that a company’s resources (assets) are financed by its obligations to others (liabilities) or by the owners’ investment (equity).”

3. Explain the difference between accrual accounting and cash accounting.

This question delves into a core principle of accounting.

Answer: “Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or paid. Cash accounting, on the other hand, recognizes revenue and expenses only when cash is received or paid. Accrual accounting is typically used by larger companies because it provides a more accurate picture of a company’s performance, while cash accounting is simpler to use for smaller businesses.”

4. Define depreciation and explain how it’s calculated.

Depreciation is a crucial concept in accounting, and you’ll likely face questions about it.

Answer: “Depreciation is the systematic allocation of the cost of a long-lived asset over its useful life. It recognizes the gradual decrease in value of an asset due to wear and tear, obsolescence, or passage of time. Depreciation is calculated using various methods, including the straight-line method, double declining balance method, and the sum of the years’ digits method. The chosen method depends on the asset and the company’s accounting policies.”

5. What is inventory and how is it valued?

Inventory is a critical component of many businesses, with various accounting methods for valuation.

Answer: “Inventory refers to the goods a company holds for sale in the ordinary course of business. It’s a significant asset on the balance sheet and can be valued using different methods. The three main methods are FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and weighted average. FIFO assumes that the oldest inventory is sold first, LIFO assumes that the newest inventory is sold first, and the weighted average method uses an average cost to value inventory.”

6. Describe the different types of audits.

Understanding the different types of audits demonstrates your knowledge of the accounting profession.

Answer: “There are various types of audits conducted by professional accountants. The most common are financial statement audits, which evaluate the fairness of a company’s financial statements. There are also operational audits, which focus on the efficiency and effectiveness of a company’s operations. Compliance audits assess whether a company is complying with relevant laws and regulations, and internal audits are conducted by a company’s internal audit department to assess and improve risk management and internal controls.”

7. What is the difference between accounts payable and accounts receivable?

This question is about basic accounting terms and their significance.

Answer: “Accounts payable represents money owed by a company to its suppliers for goods or services that have been received but not yet paid for. Accounts receivable, on the other hand, represents money owed to a company by its customers for goods or services that have been delivered but not yet paid for.”

8. How do you handle a journal entry?

This question assesses your practical knowledge of accounting processes.

Answer: “A journal entry is the initial recording of a financial transaction in the accounting system. Journal entries follow the double-entry bookkeeping method, ensuring that every transaction affects at least two accounts. When creating a journal entry, I ensure that the total debits equal the total credits. This helps maintain the accounting equation (Assets = Liabilities + Equity) and ensures the accuracy of the financial records.”

9. What is a variance analysis?

This question tests your analytical skills and understanding of performance tracking.

Answer: “A variance analysis is a process of comparing actual results to planned or budgeted results. It helps identify deviations from expectations and provides insights into why those deviations occurred. Variance analysis can be applied to various areas, such as sales, costs, expenses, and production. By identifying and analyzing variances, companies can improve their planning processes, optimize resource allocation, and enhance operational efficiency.”

10. What are your strengths and weaknesses as an accountant?

This is a typical interview question that explores your self-awareness and professional development.

Answer: “One of my key strengths is my attention to detail. I meticulously review financial data and ensure accuracy in my work. I’m also a strong analytical thinker, capable of identifying trends and patterns in financial information. This allows me to provide valuable insights to stakeholders. As for weaknesses, I’m continually developing my skills in using advanced accounting software. However, I’m actively seeking opportunities to enhance my proficiency in these systems.”

Tips for Acing Your Accounting Interview

In addition to knowing your accounting basics, these tips can help you stand out:

1. **Practice, Practice, Practice:** Prepare for common questions, such as those already outlined in this guide. The more you practice, the more confident you’ll feel. Use flash cards, mock interviews, or even record yourself answering questions to pinpoint areas for improvement.

2. **Research the Company:** Before the interview, take the time to research the company’s industry, competitors, and recent news. Demonstrating familiarity with the company shows your genuine interest and initiative. This could include reviewing their annual reports for insights into their financial performance.

3. **Be Prepared to Discuss Specific Situations:** Interviewers often ask situational questions to assess your judgment and decision-making abilities. Think about situations where you’ve encountered challenges or had to apply your accounting skills. Be prepared to describe how you approached the situation and what you learned from it.

4. **Demonstrate Your Skills:** Go beyond simply listing your skills. Provide concrete examples that showcase your proficiency in key areas like financial analysis, communication, and problem-solving. For instance, you could describe a project where you used your analytical skills to improve a budgeting process.

5. **Ask Thoughtful Questions:** At the end of the interview, ask insightful questions about the role or the company. This demonstrates your continued engagement and interest. It’s a good opportunity to clarify any uncertainties you have.

Accounting Interview FAQ

Here are some frequently asked questions and answers:

Q: What are some must-have soft skills for an accountant?

A: Besides technical skills, accountants need excellent communication skills to explain complex financial information to clients and stakeholders. They need strong problem-solving abilities to identify and resolve financial discrepancies and analytical skills to interpret trends and provide valuable insights.

Q: How can I prepare for behavioral questions in an accounting interview?

A: Think about situations that demonstrate your skills and abilities. Prepare examples that highlight your problem-solving, communication, teamwork, and leadership qualities. Share stories that showcase your approach to handling pressure, meeting deadlines, or working under challenging conditions.

Q: What salary should I expect for an entry-level accounting position?

A: Salary for entry-level accounting positions vary depending on location. Research online salary websites or consult with industry professionals to determine the typical salary range in your area. It’s also crucial to consider the specific company, its size, and industry.

Q: What are some popular accounting certifications?

A: Certifications can enhance your credentials and demonstrate your commitment to the profession. Some well-regarded accounting certifications include the Certified Public Accountant (CPA), Certified Management Accountant (CMA), and Certified Internal Auditor (CIA). These certifications require specific education and experience qualifications, and passing rigorous exams.

Basic Accounting Questions And Answers For Interview Pdf

Conclusion

Armed with the basic accounting knowledge, practice interview questions, and proven tips in this guide, you’re well-equipped to ace your next accounting interview. Remember to stay calm, showcase your passion for the field, and demonstrate your ability to contribute meaningfully to the company’s success. Are you ready to tackle your next accounting interview with confidence?