The other day, I was helping my grandmother organize her paperwork and came across a stack of old cheques. While some were for past utilities or services, one stood out – a large cheque from her deceased uncle’s estate. She wanted to deposit it, but she wasn’t sure how to go about it. This experience made me realize that many people might not be familiar with the process of requesting a cheque deposit, especially in today’s digital age. So, today, we’re going to dive into the details of writing a request letter to deposit a cheque into your account.

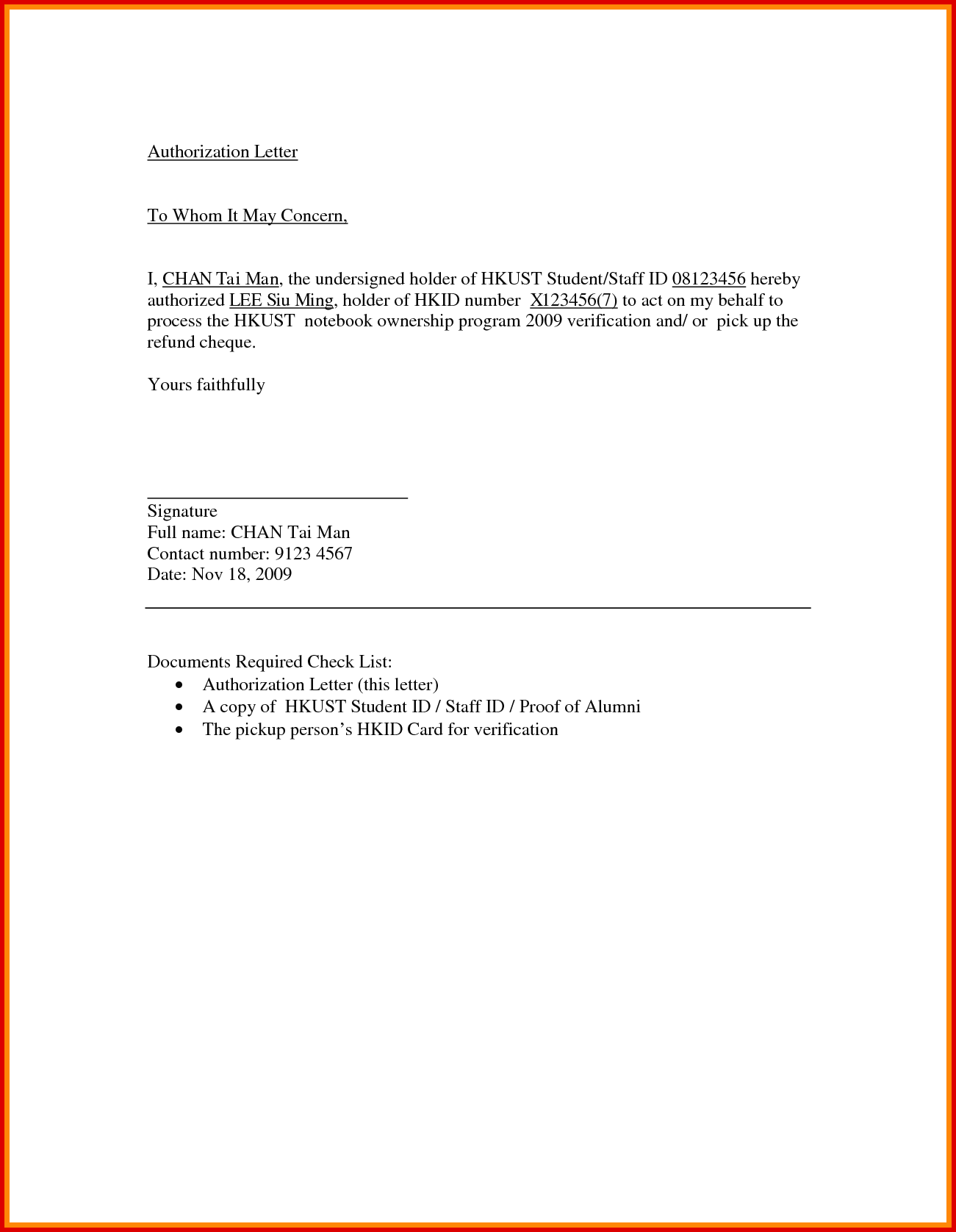

Image: authorizationletter.net

A simple request letter can make the process of depositing a cheque a lot easier. It’s a formal way to formally communicate your request to your bank, ensuring they understand your intention and have all the necessary information to process your cheque deposit.

Understanding The “Request Letter”

A request letter is a concise and formal document that outlines your specific request to a particular institution, person, or organization. In the context of depositing a cheque, this letter serves as a clear and written communication between you and your bank, explaining your intention to deposit the cheque into your account and providing all the necessary details for smooth processing.

Think of it as a formal handshake – you’re initiating a transaction by providing clear instructions and documentation, leaving no room for misinterpretation or confusion. A well-written request letter can also be beneficial in cases where you need to deposit a cheque that requires special handling, such as a large sum or a cheque that was endorsed by someone else.

The Components of a Cheque Deposit Request Letter

Crafting a request letter for cheque deposit is a straightforward process. Here’s a comprehensive guide on the key elements and formatting to ensure your request is clear and effective:

1. Your Contact Information:

- Your Full Name: Start with your complete name, ensuring it’s written clearly and correctly.

- Your Account Number: Provide the account number where you want the cheque deposited. Double-check the accuracy of the number.

- Your Address: Include your complete address, including zip code, for accurate record-keeping.

- Your Phone Number: Provide a valid phone number to facilitate communication if there are any queries or issues.

- Your Email Address: Include your preferred email address for further communication and updates.

Image: ellapritchard.z19.web.core.windows.net

2. Recipient’s Information:

- Bank Name: Clearly state the name of the bank where you want the cheque deposited.

- Address: Include the bank’s complete address, including branch information (if applicable).

- Contact Person (Optional): If you have a specific contact person at the bank, mention their name and title.

3. Subject Line:

- Clear and Concise: Opt for a straightforward subject line that clearly indicates the purpose of the letter, such as “Request to Deposit Cheque” or “Cheque Deposit Request.”

4. Opening Paragraph:

- Introduce Yourself: Begin by stating your name and briefly introduce yourself. If you have an existing account with the bank, you can mention that as well.

- Purpose of the Letter: Clearly state the purpose of your letter—that you are requesting a cheque deposit. This sets the tone for the rest of your request.

5. Details of the Cheque:

- Cheque Number: Provide the cheque number clearly and accurately.

- Date on the Cheque: Mention the date printed on the cheque.

- Amount of the Cheque: Include the amount in numerical and written form (e.g., “One Thousand Dollars” or “$1000”).

- Payee: State who the cheque is made out to.

- Drawer: Provide the name of the person or organization who issued the cheque.

- Endorsements: If the cheque requires any endorsements, specify who has endorsed the cheque and the date of the endorsement.

6. Additional Information:

- Special Instructions: If you have any specific instructions regarding the handling of the cheque, such as holding it until a specific date or requiring a specific bank officer to process it, clearly mention these instructions.

- Confirmation: Request confirmation once the cheque has been deposited into your account. You may want to include how you prefer the confirmation to be provided (e.g., email or phone call).

7. Closing Paragraph:

- Express Gratitude: Thank the bank for their assistance and cooperation in processing your request.

- Offer Contact Information: Reiterate your contact information, making it easy for the bank to get in touch with you if needed.

8. Signature:

- Legible Signature: Ensure your signature is clear and legible.

- Date: Write the date on which you are sending the letter.

Cheque Deposit Request Letter: Sample Format

To create a professional request letter, you can model your letter after this sample format. Remember to customize the information to fit your specific situation.

[Your Full Name]

[Your Account Number]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Bank Name]

[Bank Branch Address]

Subject: Request to Deposit Cheque

Dear [Bank Official’s Name] (Optional),

This letter is to formally request a deposit of a cheque into my account. I am the account holder of [Your Account Type], account number [Your Account Number]. I am requesting the deposit of the accompanying cheque, details of which are provided below:

Cheque Number: [Cheque Number]

Date on Cheque: [Cheque Date]

Amount: [Amount in Figures] ([Amount in Words])

Payee: [Payee Name]

Drawer: [Drawer Name]

[Include any additional information as needed, such as endorsements or special instructions]

Kindly confirm the deposit once the cheque has been processed. I can be reached at [Your Phone Number] or [Your Email Address].

Thank you for your time and assistance.

Sincerely,

[Your Signature]

Expert Tips for Writing Your Cheque Deposit Request Letter

To ensure your request letter is effective, here are some additional expert tips to keep in mind:

- Keep it Concise: Get to the point quickly without unnecessary details.

- Proofread Carefully: Before submitting your letter, check for any spelling, grammar, or typographical errors.

- Formal and Professional Tone: Maintain a formal and professional tone throughout the letter.

- Attach the Cheque: If sending the letter physically, remember to attach the cheque securely. Alternatively, if submitting online, scan the cheque and attach the image.

FAQs: Addressing Your Queries

Here are some common questions you might have about depositing cheques by request letter:

Q: When should I use a request letter?

A: It is recommended to use a request letter if you are depositing a large cheque, a cheque requiring special handling, or simply wish to ensure a clear and documented record of the deposit process with your bank.

Q: What if I cannot physically deliver the cheque to the bank?

A: You can send the request letter to the bank along with a scanned image of the cheque. Ensure the image is clear and legible for proper processing.

Q: Is there a specific format for the request letter?

A: While there is no set format, the guidelines and sample template provided in this article offer a reliable structure. It’s essential to be clear, concise, and professional in your communication.

Q: How long does it take for the deposit to be processed?

A: The time required for a cheque deposit can vary. It is advisable to check with your bank for information on the typical processing times. You can also indicate a preferred processing timeframe in your request letter, if applicable.

Request Letter To Deposit Cheque In My Account

Conclusion

A request letter to deposit a cheque into your bank account provides a structured and formal approach to managing this transaction. By understanding the components of a well-written letter, you can ensure your request is clear, accurate, and processed efficiently.

Are you interested in learning more about other banking processes or document writing? Let me know in the comments below!