Have you ever felt the weight of a mortgage you didn’t sign up for? Maybe you were in a relationship that ended, or perhaps you co-signed a loan for a loved one who couldn’t qualify on their own. The aftermath can leave you stuck with a financial burden you never intended to bear. It’s a situation many people find themselves in, and it’s not something to face alone. This article provides a roadmap for navigating this complex process and offers a sample letter that can help you reclaim control over your finances.

Image: www.pinterest.com

Removing your name from a mortgage isn’t a simple task. It involves legal processes, communication with lenders, and potentially negotiating with the other party involved. However, it’s achievable, and with the right approach and a carefully crafted letter, you can take significant steps towards financial freedom.

Understanding the Basics of Mortgage Removal

Before we delve into the letter itself, let’s understand the key principles at play:

- Refinancing: This involves obtaining a new loan to replace the existing mortgage. The original mortgage is paid off, and the new loan is issued. If your name is to be removed, a new mortgage will be issued in the name of the remaining borrower.

- Loan Assumption: In this scenario, another party agrees to take over the existing mortgage, assuming all the responsibilities associated with it. Technically, the original mortgage remains, but the lender is now working with the new borrower.

- Short Sale: This involves selling the property for less than the outstanding mortgage balance. This is a complex process and can have tax implications, so careful consideration is required.

- Foreclosure: This is the legal process of the lender taking possession of the property after the borrower fails to make payments. It’s a last resort and should be avoided if possible.

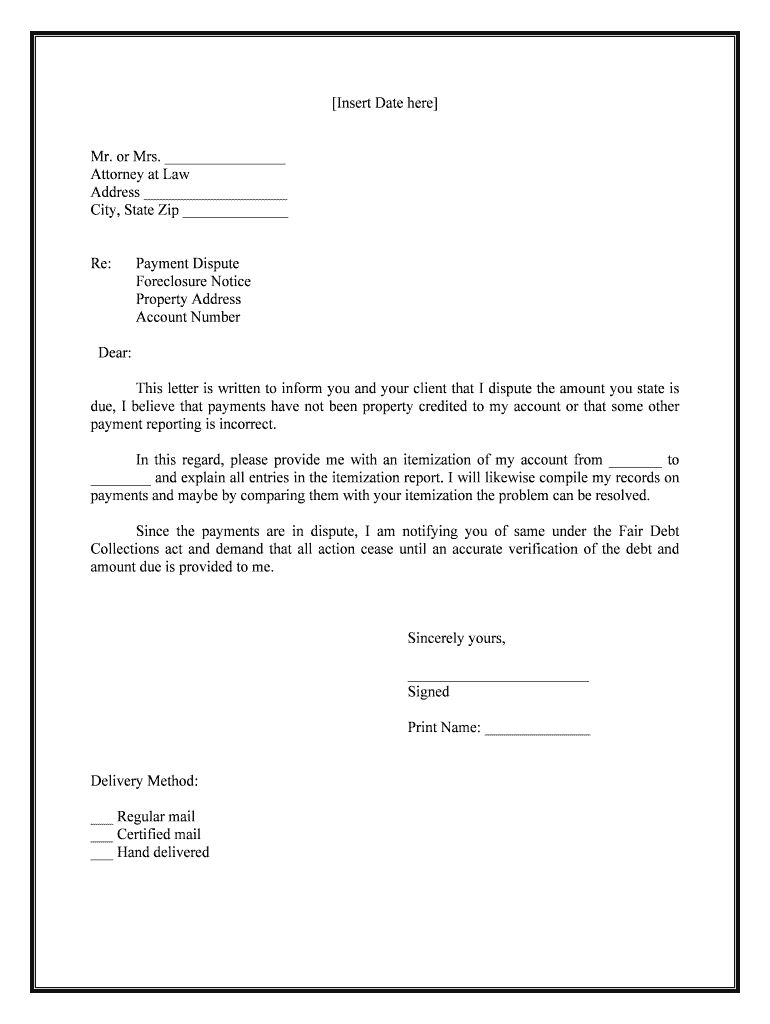

Crafting Your Request: A Sample Letter for Mortgage Removal

A well-structured letter to your lender provides a formal, clear request for the removal of your name from the mortgage. Here’s a sample letter you can adapt to your specific circumstances:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Name of Lender]

[Address of Lender]

Re: Request to Remove Name from Mortgage Account [Mortgage Account Number]

Dear [Name of Lender Representative],

This letter formally requests the removal of my name from the mortgage account related to property located at [Property Address]. The mortgage account number is [Mortgage Account Number].

[State the reason for your request clearly and concisely. Examples include:

- “I am requesting the removal of my name due to the recent dissolution of my marriage/partnership with [Name of other borrower].”

- “I would like to be released from my obligation on the mortgage due to financial hardship caused by [briefly explain the situation].”

[If applicable, mention any specific agreements or arrangements you’ve made with the other borrower:

- “We have reached an agreement regarding the distribution of property and the ongoing liability of the mortgage. [Name of other borrower] will be responsible for future payments.”

[Clearly state your desired outcome:

- “I request that my name be officially removed from the mortgage contract as soon as possible. Please provide me with any necessary documentation or instructions to complete this process.”

[Include any relevant supporting documents:

- “I have attached a copy of [documentation to support your request, such as a divorce decree, separation agreement, or financial hardship documentation]”

Thank you for your prompt attention to this matter. I look forward to discussing this further and resolving this issue in a timely manner.

Sincerely,

[Your Signature]

[Your Typed Name]

Key Considerations When Writing Your Letter

- Professionalism: Maintain a professional tone throughout the letter. Be polite and respectful, even if you are frustrated with the situation.

- Clarity and Conciseness: Use clear language and avoid jargon. State your request and supporting information concisely.

- Legality: Ensure your letter is legally sound. If you are seeking the removal of your name due to a legal event (such as a divorce), include relevant legal documentation.

- Proof of Identity: Don’t forget to include your name, address, and phone number at the top of the letter.

- Proof of Mailing: Send the letter by certified mail with return receipt requested to ensure its delivery and create a record of your communication.

Image: www.vrogue.co

Talking to Your Lender

A letter is just the first step. You’ll likely need to follow up with your lender to discuss your request in more detail. Be prepared to provide further documentation and information, and be ready to answer any questions they may have. If you are dealing with a difficult situation, you may want to consult with an attorney to understand your legal options.

Sample Letter To Remove Name From Mortgage

Navigating the Challenges: Finding Solutions and Support

Removing your name from a mortgage can be challenging, but it’s possible. Remember, you’re not alone in this journey. Reach out to a trusted financial advisor, lawyer, or a credit counseling agency for guidance and support. Remember, even the most difficult financial situations are solvable with the right advice and a proactive approach. By taking control of your situation and pursuing legal options, you can work towards a future free from unwanted financial burdens.