Imagine yourself facing an unexpected financial hurdle, a car repair gone wrong or a medical bill that arrived sooner than expected. While a paycheck might seem weeks away, immediate financial relief is needed. This is where an employee salary cash advance letter becomes a crucial tool, offering a lifeline for employees in need while adhering to company policies.

Image: www.myxxgirl.com

An employee salary cash advance letter is a formal request submitted to your employer outlining your need for a portion of your upcoming salary in advance. This request must adhere to specific formatting standards and company protocols to ensure a smooth process and approval. Understanding the proper format, essential content, and ethical considerations associated with these letters is crucial for both employees and employers.

Understanding the Need for Cash Advance

Life is unpredictable, and financial emergencies can arise at any moment. Salary cash advances offer a temporary solution for employees facing unexpected expenses. These situations might include:

- Medical Emergencies: Unexpected illness or injury demanding immediate medical attention.

- Vehicle Repairs: Unforeseen breakdown requiring immediate repair to avoid further financial strain.

- Home Repairs: Urgent repairs to prevent damage or jeopardize safety.

- Family Emergencies: Unexpected travel or assistance required for a family member’s well-being.

- Other Urgent Expenses: Unexpected bill payments, unavoidable debt obligations, or unforeseen situations requiring immediate funds.

The Importance of a Well-Written Letter

A professional and concise employee salary cash advance letter is crucial for two main reasons:

1. Demonstrates Professionalism and Respect:

Presenting a well-structured letter to your employer reflects your respect for their time and company policies. It demonstrates your understanding of the process and your commitment to adhering to established procedures.

Image: www.bizzlibrary.com

2. Clarifies Your Needs and Ensures a Smooth Process:

A well-written letter ensures clear communication of your situation. It outlines the reason for your request, the desired amount, and your plan for repayment. This clarity facilitates a swift and efficient evaluation and minimizes misunderstandings between you and your employer.

Anatomy of a Salary Cash Advance Letter

Structuring your employee salary cash advance letter effectively is crucial for achieving its purpose. Here’s a breakdown of the key components:

1. Heading:

Start by clearly stating the purpose of the letter. Place “Salary Cash Advance Request” at the top, followed by your name and contact information. Include your employee ID, if applicable.

2. Salutation:

Address your letter to the appropriate individual, typically your immediate supervisor, payroll department, or human resources manager. Use a formal salutation like “Dear [Name]” or “Dear [Designation].”

3. Introduction:

Begin with a brief and polite introduction stating your purpose: “I am writing to request a salary cash advance.”

4. Explanation of the Emergency:

Provide a concise and clear explanation of the unexpected expense requiring the advance. Be specific about the situation and avoid dwelling excessively on personal details. For example, “I am facing an unexpected car repair bill of [amount]” or “I need to cover an urgent medical expense.”

5. Request Amount:

Clearly state the specific amount of cash advance you require. Ensure that the amount is reasonable and you can realistically repay it by your next salary date.

6. Repayment Plan:

Outline your proposed repayment plan. Specify the date by which you will repay the advance and how you plan to do so (e.g., through payroll deduction). This shows responsibility and commitment to fulfilling your obligations.

7. Closing:

End the letter with a polite closing. Express your gratitude for their consideration. Use a formal closing like “Sincerely” or “Yours sincerely.”

8. Signature:

Sign your name clearly below your closing. Type your name beneath your signature for readability.

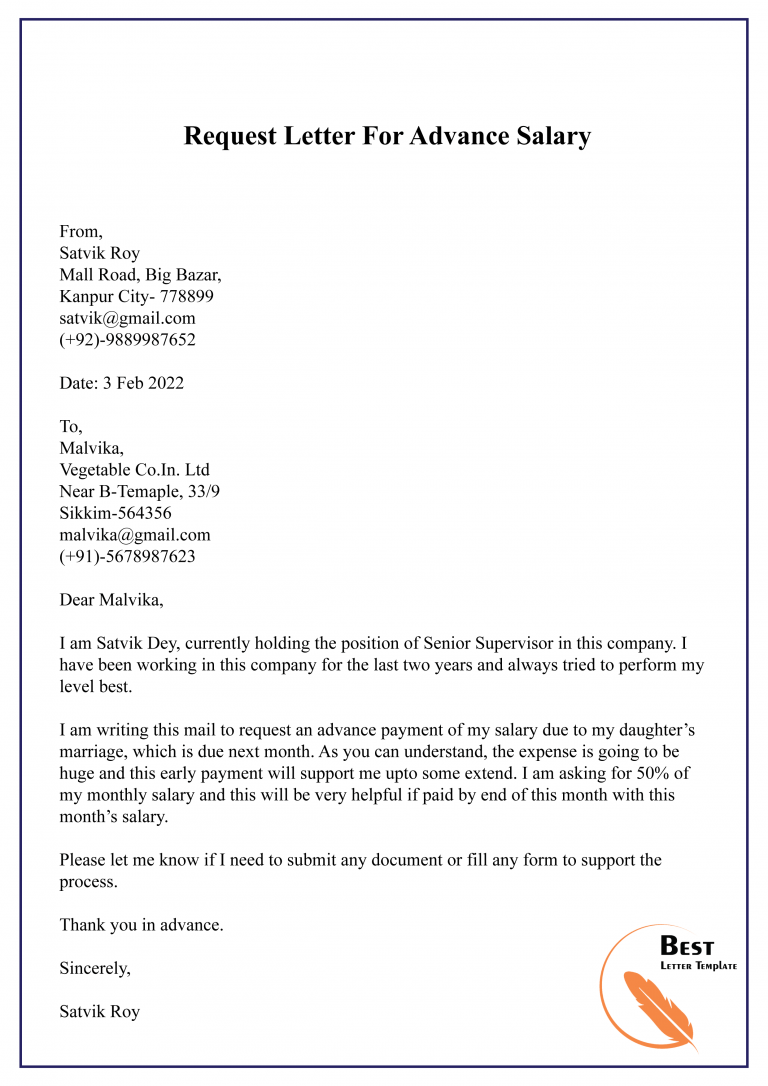

Example Salary Cash Advance Letter Format:

Employee Salary Cash Advance Request

[Your Name]

[Your Employee ID]

[Your Contact Information]

[Date]

Dear [Supervisor/Payroll Department/HR Manager],

I am writing to request a salary cash advance.

I am facing an unexpected [reason for cash advance]. The estimated cost of [expense] is [amount], which needs to be addressed immediately.

I request a salary cash advance of [amount] to cover this unforeseen expense. I will repay the advance in full by [date] through [method of repayment, e.g., payroll deduction].

Thank you for your understanding and consideration.

Sincerely,

[Your Signature]

[Your Typed Name]Ethical Considerations and Employer Policies

While salary cash advances offer temporary financial relief, it’s crucial to be mindful of the ethical and practical implications:

- Company Policies: Every company has its own policies regarding salary cash advances. Carefully review your company’s employee handbook or contact HR to understand the eligibility criteria, limits, and repayment terms.

- Frequency: Avoid frequent requests for cash advances. This can raise concerns about your financial management and potentially strain your employer’s resources.

- Transparency and Honesty: Be truthful and transparent about your situation. Avoid exaggerating the urgency or fabricating reasons for the request.

- Repayment Commitment: Make every effort to repay the advance as promised, and communicate any delays promptly.

Alternative Financial Solutions

Before requesting a salary cash advance, consider exploring alternative financial options, such as:

- Short-Term Loans: Explore small personal loans from banks or credit unions with manageable interest rates.

- Credit Cards: Utilize a credit card with a low introductory APR to manage temporary expenses, but prioritize repayments to avoid accumulating high interest charges.

- Borrowing from Family and Friends: Discuss borrowing funds with trusted family or friends who might be more flexible with repayment terms.

- Savings: Establish a savings plan to create a financial cushion for unforeseen situations and avoid relying on salary advances.

Employee Salary Cash Advance Letter Format

Conclusion

Employee salary cash advance letters play a vital role in navigating unexpected financial situations. Understanding the proper format, incorporating essential details, and adhering to company policies are key to successfully obtaining the needed funds. Remembering the ethical considerations and exploring alternative financial avenues is essential for managing your financial wellbeing responsibly. Whether you’re seeking an emergency solution or building a more secure financial future, seeking informed options is crucial for navigating the complexities of personal finances.