Imagine this: you’re staring at a seemingly endless spreadsheet, rows and columns filled with numbers that seem to hold no meaning. You’ve been tasked with making decisions, perhaps for your business or personal finances, but those cryptic figures leave you feeling overwhelmed and uncertain. This feeling is far from unique. Many individuals, even those in business professions, struggle to decipher the true meaning behind the numbers in accounting. Understanding these figures is not just about passing an exam or fulfilling a professional requirement; it’s about gaining the power to make informed decisions and achieving financial success.

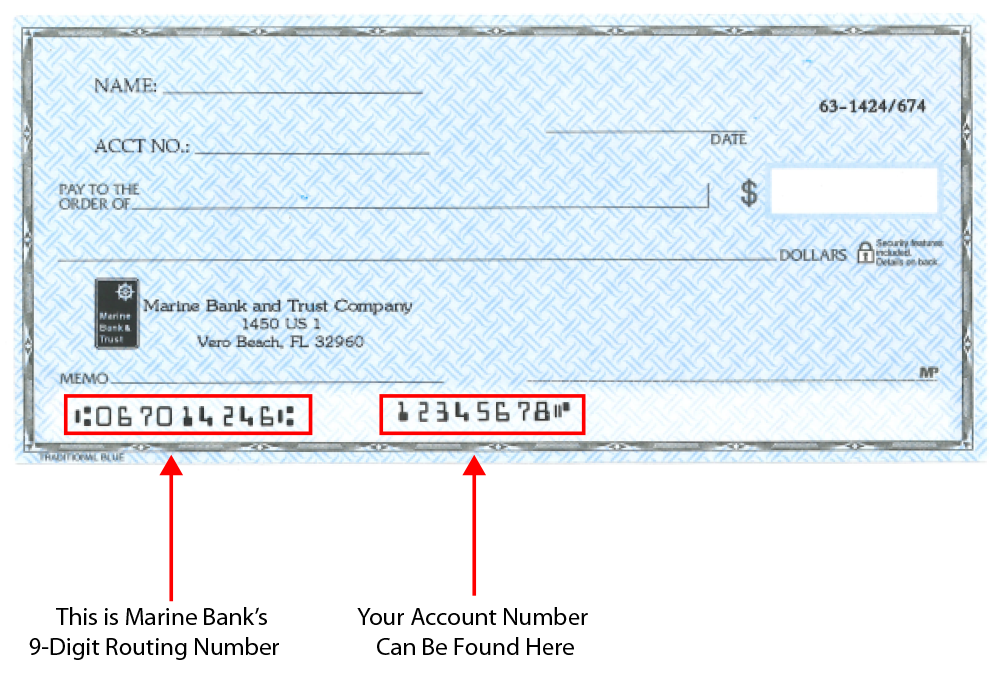

Image: www.marinebankandtrust.com

This article embarks on a journey to demystify the world of accounting, revealing how seemingly abstract numbers can guide us toward our financial goals. We’ll explore the fundamental concepts, delve into the language of accounting, and equip you with the knowledge to interpret financial statements with confidence. From balance sheets to income statements, we’ll unravel the secrets hidden within these documents and show how they can illuminate the path towards financial clarity and control.

Understanding the Language of Numbers: A Deep Dive

Before diving into specific financial statements, it’s essential to grasp the basic vocabulary of accounting. Think of it as learning a new language, and each term is a building block that will help you understand the bigger picture.

Assets: Assets are the resources owned by a company or individual. Imagine them as the possessions you hold, such as your car, house, or the cash in your bank account. Assets are categorized based on their liquidity, or how easily they can be converted to cash.

- Current Assets: These are assets that can be easily liquidated within a year, including cash, accounts receivable (money owed by customers), and inventory.

- Fixed Assets: Think of these as your long-term investments, like land, buildings, or equipment. They are not meant for immediate resale.

Liabilities: Liabilities represent the financial obligations a company or individual owes to others. They are essentially debts, like loans, mortgages, or unpaid bills.

- Current Liabilities: These debts must be paid within a year, like salaries payable, rent payable, or accounts payable (money owed to suppliers).

- Long-Term Liabilities: These are debts with a repayment term of more than a year, such as mortgages or long-term loans.

Equity: Equity is the difference between what a company or individual owns (assets) and what they owe (liabilities). It represents the net worth of the entity. Simply put, equity is your stake in a business or your personal wealth.

Revenue: Revenue is the income earned from a company’s operations. It’s the money flowing into the business from sales of goods or services, like selling a product or offering a consultation.

Expenses: Expenses are the costs incurred in generating revenue or operating a business. Think of these as the money flowing out, like salaries, rent, supplies, or utilities.

Profit (Net Income): Profit represents the difference between revenue and expenses. It represents the financial gain achieved after paying all the necessary costs.

Deciphering the Balance Sheet: A Snapshot of Financial Health

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It lays out the company’s assets, liabilities, and equity, adhering to the fundamental accounting equation:

Assets = Liabilities + Equity

Imagine the balance sheet as a two-sided scale. On one side, you have the assets, representing what the company owns. On the other side, you have liabilities and equity, representing how those assets were financed.

- Current Assets: This section showcases the company’s liquid resources, including cash, accounts receivable, and inventory. A healthy balance in current assets indicates a company’s ability to meet its short-term obligations.

- Fixed Assets: This section lists the company’s long-term investments, like property, plant, and equipment. A robust fixed asset base signals a company’s commitment to its operations and potential future growth.

- Current Liabilities: This section reveals debts that must be settled within a year, like accounts payable and salaries payable. A high level of current liabilities indicates a company might struggle to meet its immediate financial obligations.

- Long-Term Liabilities: This section lists debts with repayment terms exceeding a year, like loans and mortgages. A significant amount of long-term liabilities could suggest a company is burdened by debt and may face challenges in meeting its financial obligations.

- Equity: This section displays the company’s net worth, representing the value owned by shareholders. A strong equity position signifies a company’s financial stability and its ability to weather potential challenges.

Uncovering Profits with the Income Statement

The income statement, also known as the profit and loss (P&L) statement, showcases a company’s financial performance over a specific period, typically a month, quarter, or year. It reveals how much revenue the company generated, the expenses it incurred, and ultimately, the net income (profit) or loss incurred during that period.

- Revenue: This section reflects the income earned from the company’s operations. A consistent and growing revenue stream signals a healthy business model.

- Cost of Goods Sold (COGS): This section represents the direct costs associated with producing or obtaining the goods sold. This includes materials, labor, and other manufacturing expenses. Analyzing COGS can help identify opportunities for cost optimization.

- Operating Expenses: These are the expenses incurred in running the business, including rent, utilities, salaries, and marketing costs. Monitoring operating expenses can help improve efficiency and maintain profitability.

- Net Income (Profit): This is the most crucial figure on the income statement, representing the company’s overall profitability.

Image: chartwalls.blogspot.com

Profitability Ratios: Gauging Financial Success

Profitability ratios paint a picture of a company’s income-generating ability and its success in managing its expenses. Here are some key ratios to consider:

- Gross Profit Margin: This ratio reflects the percentage of revenue remaining after accounting for the cost of goods sold. A high gross profit margin indicates that the company is generating sufficient revenue to cover its production costs.

- Operating Profit Margin: This ratio reveals the percentage of profit remaining after deducting operating expenses. It highlights the company’s success in managing its day-to-day operations.

- Net Profit Margin: This ratio measures the percentage of net income earned relative to revenue. It indicates the company’s overall profitability after accounting for all expenses.

Financial Statement Analysis: Beyond the Numbers

While understanding the numbers is crucial, financial statement analysis goes beyond simply reading the figures. It requires critical thinking, comparing data across periods, and considering factors like market trends and industry competition.

- Trend Analysis: Analyze changes in financial data over time to identify patterns, strengths, and weaknesses.

- Industry Benchmarking: Compare financial metrics to industry averages to gauge a company’s performance relative to its peers.

- Ratio Analysis: Use financial ratios to assess various aspects of a company’s financial health, including liquidity, profitability, and efficiency.

- Cash Flow Statement: This statement provides insight into a company’s cash flow activities, breaking down cash inflows and outflows related to operations, investments, and financing. It offers a crucial understanding of the company’s cash position and its ability to fund its operations.

Unlocking Opportunities: Practical Applications of Accounting Knowledge

Now that you have a foundational grasp of accounting, let’s explore practical ways to apply this knowledge to your personal and professional life:

- Personal Finance Management: Use your newfound understanding to track your income, expenses, assets, and liabilities. This will enable you to make informed decisions about budgeting, savings, and investments.

- Business Decision-Making: Use financial statements to assess the financial health of your business, identify areas for improvement, and make informed strategic decisions about pricing, marketing, and expansion.

- Investing: Analyze financial statements before making investments to assess the viability of a company and assess its potential for growth.

Accounting What The Numbers Mean Pdf

Next Steps: Continuing Your Journey in Accounting

Unlocking the secrets of accounting is an ongoing journey. Here are some ways to continue exploring:

- Take a course or workshop: Enroll in a formal accounting class or attend a workshop specializing in financial statement analysis.

- Read industry publications: Stay current with the latest trends and developments in accounting by subscribing to industry publications and blogs.

- Network with professionals: Connect with accountants and financial analysts to learn from their expertise and gain valuable insights.

In Conclusion: Empowering Yourself with Accounting Knowledge

Accounting may seem like a complex world of numbers, but it’s not an unbreakable code. By understanding the fundamental concepts, vocabulary, and analysis techniques, you can gain valuable financial literacy that empowers you to make informed decisions, navigate financial complexities, and ultimately, achieve your financial goals. Start your journey today, and you’ll be surprised at how much clarity and control you can achieve.