The pursuit of financial freedom is a universal desire. We all dream of a life where money is no longer a source of stress, but a tool for achieving our goals and living our best lives. But the path to wealth can seem daunting, filled with confusing financial jargon and complex investment strategies. This is where “I Will Teach You to Be Rich” comes in, a book that has become a guiding light for countless individuals seeking to achieve financial independence.

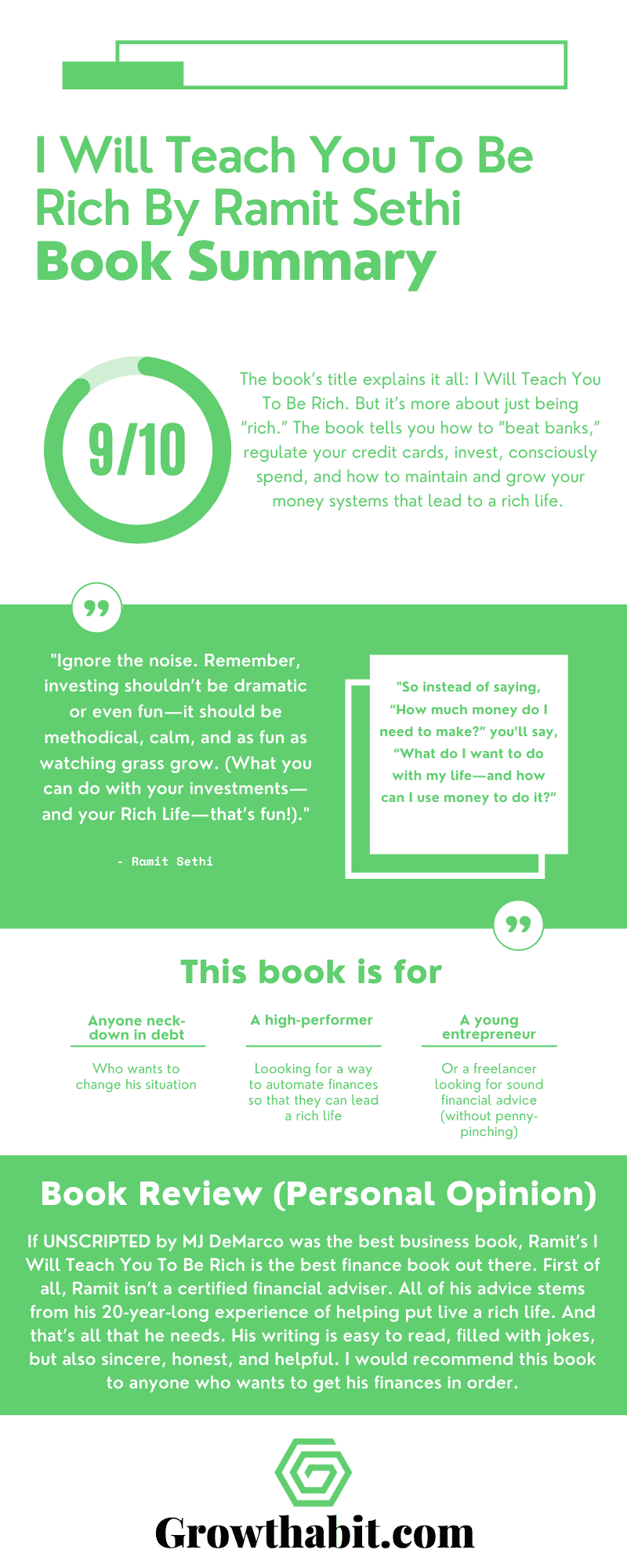

Image: growthabit.com

In this article, we’ll delve into the world of I Will Teach You to Be Rich: The Journal PDF. We’ll explore the book’s core principles, its impact on personal finance, and how it can empower you to take control of your financial future. We’ll also discuss the importance of financial literacy, the latest trends in personal finance, and tips from financial experts that can help you on your journey to financial freedom.

The Essence of “I Will Teach You to Be Rich”

I Will Teach You to Be Rich, authored by Ramit Sethi, is a comprehensive guide to personal finance that breaks down complex financial concepts into easily digestible chunks. The book takes a practical, actionable approach, focusing on real-world strategies for managing money effectively. Sethi’s philosophy revolves around empowering individuals to take charge of their finances by building a strong foundation of financial literacy and adopting effective money management practices.

One of the key themes of the book is the importance of automating your finances. Sethi emphasizes the power of setting up automatic transfers and payments to ensure that your savings and bills are taken care of consistently. This automation approach eliminates the need for manual tracking and reduces the potential for errors, allowing you to focus on achieving your financial goals.

Understanding the Journal PDF

“I Will Teach You To Be Rich: The Journal PDF” is a downloadable resource that complements the main book. This journal provides a structured framework for readers to track their expenses, set financial goals, and monitor their progress. It’s a practical tool that encourages active participation in personal finance management, helping individuals stay accountable and motivated in their quest for financial freedom.

The journal is structured around a series of prompts and questions that guide you through different aspects of your financial life. It encourages you to analyze your spending habits, identify areas where you can save, and set realistic financial goals. By actively engaging with the journal, you can gain a deeper understanding of your financial situation and make informed decisions to improve your financial well-being.

Key Principles of “I Will Teach You to Be Rich”

The book “I Will Teach You to Be Rich” is built on several core principles that form the foundation of its approach to financial management. These principles are:

- Automate Your Finances: Make savings and bill payments automatic to ensure consistent and effortless financial management.

- Prioritize Paying Yourself First: Allocate a specific percentage of your income to savings and investment before spending on other things.

- Negotiate Your Bills: Actively negotiate lower rates for expenses like cable, internet, and credit card bills.

- Build a Strong Emergency Fund: Have a readily accessible fund to cover unexpected expenses and life’s uncertainties.

- Invest Wisely: Opt for low-cost index funds and ETFs for long-term investment growth.

This structured approach provides a roadmap for individuals to build a healthy financial foundation. By consistently applying these principles, readers can move towards achieving their financial goals and maximizing their financial potential.

Image: www.valuebury.com

The Importance of Financial Literacy

Financial literacy is the foundation of sound financial decision-making. It empowers individuals to understand basic financial concepts, make informed choices about their finances, and take control of their money. “I Will Teach You to Be Rich” emphasizes the importance of financial literacy by providing easy-to-understand explanations of key concepts and practical strategies for managing finances effectively.

The book’s approach to financial literacy is grounded in real-world experiences and practical advice. It avoids overwhelming readers with complex financial jargon, making it accessible for those who are new to personal finance. By demystifying financial concepts and providing actionable steps, the book empowers readers to develop the financial literacy necessary to navigate the complex world of money management.

Latest Trends in Personal Finance

The world of personal finance is constantly evolving, with new technologies and trends emerging regularly. “I Will Teach You to Be Rich” demonstrates an understanding of these trends, incorporating principles and strategies that resonate with modern financial realities. For instance, the book emphasizes the use of online budgeting tools and financial tracking apps, recognizing the growing popularity of digital solutions for personal finance.

One of the most significant trends in personal finance is the increasing use of automation. From robo-advisors to automated bill pay services, technology is making it easier than ever to manage finances effectively and efficiently. The book’s emphasis on automation aligns with this trend, encouraging readers to leverage technology to streamline their financial processes and simplify their lives. Other notable trends include the rise of micro-investing platforms, the increasing popularity of personal finance podcasts and online communities, and the growing focus on ethical and sustainable investment options.

Tips and Expert Advice for Financial Success

Based on “I Will Teach You to Be Rich” principles and combined with expert advice, here are some key tips for building a solid financial foundation:

- Set Clear Financial Goals: Define what you want to achieve financially, whether it’s buying a house, saving for retirement, or starting a business. Having clear goals provides direction and motivation.

- Track Your Expenses: Analyze your spending habits to identify areas where you can cut back and reallocate funds towards your financial goals.

- Negotiate Your Bills: Don’t be afraid to negotiate lower rates for your utilities, insurance, and other expenses. Remember, you can always ask for a better deal.

- Automate Your Savings: Set up automatic transfers to your savings account on a regular basis, creating a consistent habit of saving.

- Diversify Your Investments: Do not put all your eggs in one basket. Spread your investments across different asset classes to manage risk and potentially boost your returns.

The importance of financial planning and investing wisely cannot be overstated. By consistently implementing these tips, you can build a solid foundation for financial success and work towards your financial goals. Remember, financial planning is a marathon, not a sprint. It takes time, effort, and consistency to achieve your long-term financial objectives.

FAQ:

Q: What is the target audience for “I Will Teach You to Be Rich”?

A: The book is designed for a wide audience, from individuals new to personal finance to those looking to enhance their existing knowledge and strategies. It’s particularly valuable for millennials and Gen Z, who are navigating a complex financial landscape.

Q: How can I access the “I Will Teach You to Be Rich: The Journal PDF”?

A: The journal PDF is usually available as a downloadable resource when you purchase the book or through the author’s website. You can also find it on online marketplaces like Amazon.

Q: Is “I Will Teach You to Be Rich” suitable for people with different financial situations?

A: Yes, the book’s principles are adaptable to various financial situations. Regardless of your income level, the book’s focus on practical strategies and building solid financial habits can be beneficial.

I Will Teach You To Be Rich: The Journal Pdf

Conclusion

“I Will Teach You to Be Rich” is a powerful guide to financial freedom, empowering individuals to take control of their money and achieve their financial goals. The book’s practical approach, combined with the insightful journal PDF, provides a comprehensive framework for managing finances effectively. By embracing its principles, you can build a solid financial foundation, automate your finances, and make informed decisions towards a brighter financial future.

Are you interested in learning more about “I Will Teach You to Be Rich: The Journal PDF” and how it can help you achieve your financial aspirations?