Have you ever felt bewildered by the complex world of financial statements? Do you find yourself struggling to understand the language of accounting and the intricacies of balance sheets, income statements, and cash flow statements? Fear not, because chapter 9 of your accounting textbook holds the key to unraveling these mysteries! This chapter is crucial because it lays the foundation for understanding how businesses track their financial performance and position. It’s a gateway to financial literacy and essential knowledge for anyone working with or analyzing financial information.

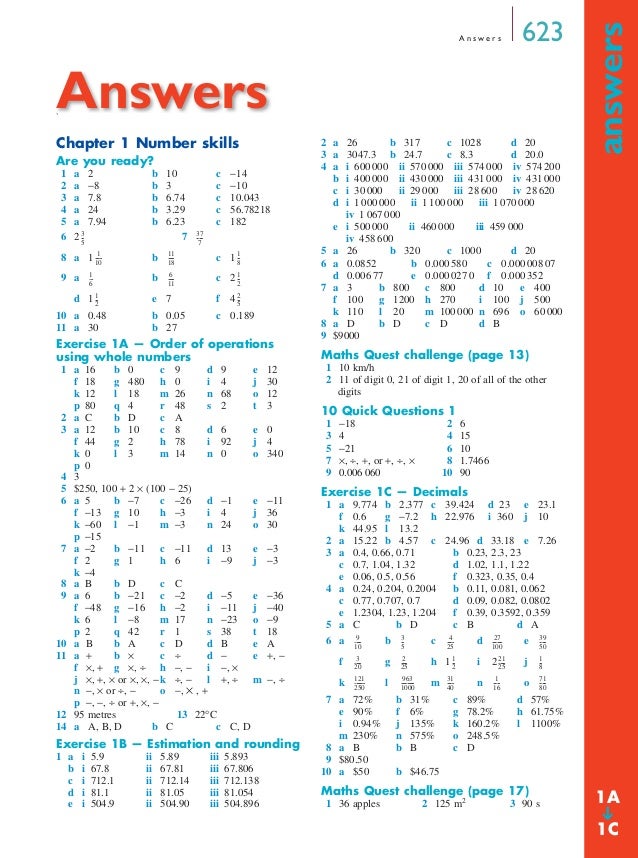

Image: dissertationguides.web.fc2.com

This article is your guide to mastering the concepts covered in chapter 9, providing an in-depth exploration of its key topics and offering valuable tips to help you succeed on your upcoming test. Whether you’re a student diligently preparing for an exam or a professional seeking a refresher on fundamental financial statements, this comprehensive guide will provide the clarity and confidence you need to navigate the financial landscape.

Understanding the Building Blocks of Financial Statements

Chapter 9 is all about the core financial statements that businesses use to communicate their financial health to investors, creditors, and other stakeholders. These statements—the balance sheet, income statement, and statement of cash flows—paint a comprehensive picture of a company’s financial performance and position over a specific period.

The balance sheet is a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Think of it as a photograph of the company’s financial position. Assets are what a company owns, liabilities are what it owes to others, and equity represents the owners’ stake in the company. The fundamental accounting equation, Assets = Liabilities + Equity, is the cornerstone of the balance sheet.

The income statement, also known as the profit and loss statement, measures a company’s financial performance over a period of time. It summarizes revenues, expenses, and the resulting net income (or loss) for a given period. Imagine the income statement as a movie documenting the flow of a company’s revenues and expenses.

The statement of cash flows reveals how much cash a company generated and used during a specific period. It analyzes cash flows from operating activities (day-to-day business operations), investing activities (purchase and sale of long-term assets), and financing activities (raising capital and paying dividends). This statement is like a detailed financial diary that tracks the movement of cash.

Delving Deeper: Crucial Concepts

Understanding the basics of these financial statements is only the beginning. Chapter 9 also delves into crucial concepts that shape how businesses report their financial information.

Accrual accounting is a core principle that requires businesses to record revenues and expenses when they are earned or incurred, regardless of when the cash is received or paid. This principle is vital for accurately reflecting the company’s full financial performance.

Matching principle is an extension of accrual accounting. It dictates that expenses be matched with the revenues they helped generate. Imagine trying to understand a movie without sound. The matching principle ensures a balanced and realistic portrayal of a company’s financial operations.

Adjusting entries are critical for ensuring that financial statements accurately reflect the company’s financial position and performance. These entries are made at the end of an accounting period to account for transactions that haven’t yet been recorded or to make adjustments for accrued or prepaid expenses and revenues. Think of adjusting entries as fine-tuning the financial statements for greater accuracy.

Mastering the Art of Analysis

While understanding the components of financial statements is essential, chapter 9 also teaches you how to analyze these statements to extract meaningful insights.

Ratio analysis is a powerful tool for analyzing financial statements and comparing a company’s performance to its industry peers or its historical performance. Ratios like profitability ratios (gross profit margin, operating margin), liquidity ratios (current ratio, quick ratio), and solvency ratios (debt-to-equity ratio, times interest earned ratio) help you assess a company’s profitability, ability to meet short-term obligations, and long-term financial health.

Common-size financial statements are another beneficial analytical tool. They express each item on the income statement and balance sheet as a percentage of a base figure, allowing for easier comparison across different periods and companies.

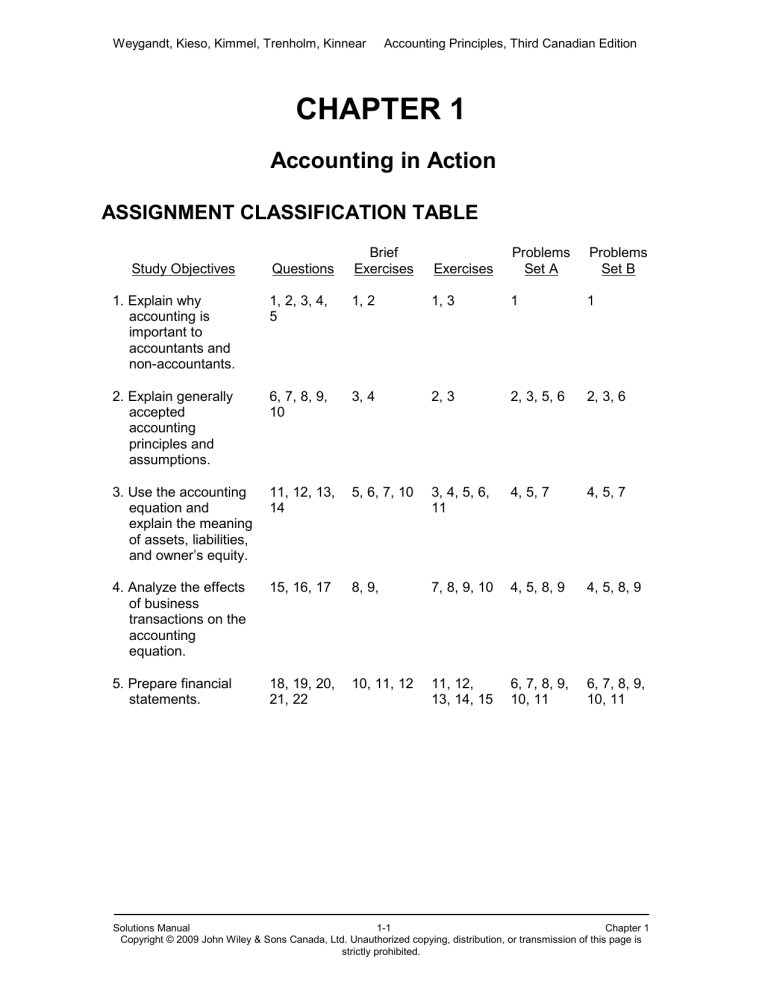

Image: studylib.net

Navigating the Test: Tips for Success

Now that you’ve grasped the key concepts and analytical tools, here are some actionable tips to help you ace your chapter 9 test:

- Practice, practice, practice: The best way to prepare for the test is through practice. Work through numerous practice problems and exercises, ensuring you understand the underlying concepts and can apply them to different scenarios.

- Seek clarification: Don’t hesitate to ask your instructor or classmates for help if any concepts remain unclear. There’s no shame in seeking additional guidance to ensure thorough understanding.

- Review past tests: If you have access to past tests or quizzes, review them carefully to identify common question types and areas that require additional focus.

- Stay organized: Organize your notes and study materials effectively to avoid feeling overwhelmed. Use techniques like mind maps, flashcards, or summaries to condense key information.

Accounting Chapter 9 Test Answer Key

Your Path to Financial Mastery

Chapter 9 is a pivotal chapter in your accounting journey, offering invaluable insights into the fundamental financial statements that businesses use to communicate their financial performance. By mastering the concepts and tools presented in this chapter, you build a strong foundation for understanding financial information and analyzing business performance. Use the tips provided, practice diligently, and embrace the power of knowledge to confidently navigate the world of accounting. Remember, the more you understand the language of financial statements, the better equipped you’ll be to make informed decisions and achieve financial success.