Remember the first time you were introduced to the balance sheet, income statement, and statement of cash flows? It felt like an entirely new language, right? For many aspiring accountants, that initial confusion often gets compounded when attempting practice sets. One common challenge is navigating the intricacies of Accounting Mini Practice Set 1, a staple in introductory accounting courses. This set, though seemingly simple, lays a vital foundation for grasping more complex accounting concepts.

Image: www.transtutors.com

As a seasoned accountant myself, I can vividly recall the frustration I experienced while tackling the first few practice sets. The concepts felt abstract, and deciphering the various journal entries seemed like an overwhelming task. But I soon realized that mastering these foundational practice sets is crucial for developing a solid understanding of accounting principles. This blog post aims to demystify Accounting Mini Practice Set 1, providing a comprehensive guide that will empower you to confidently tackle the challenges it presents.

Understanding the Purpose of Accounting Mini Practice Sets

Mini practice sets, like the one we’re focusing on, are designed to simulate real-world accounting scenarios. They provide a hands-on opportunity to apply theoretical knowledge to practical situations. These sets cover fundamental concepts like:

- Journal entries

- Trial balances

- Income statements

- Balance sheets

- Statement of cash flows

By working through these exercises, you’ll gain a deeper understanding of how different transactions affect these core financial statements. This practical experience is invaluable for solidifying your knowledge and preparing you for more complex scenarios later on.

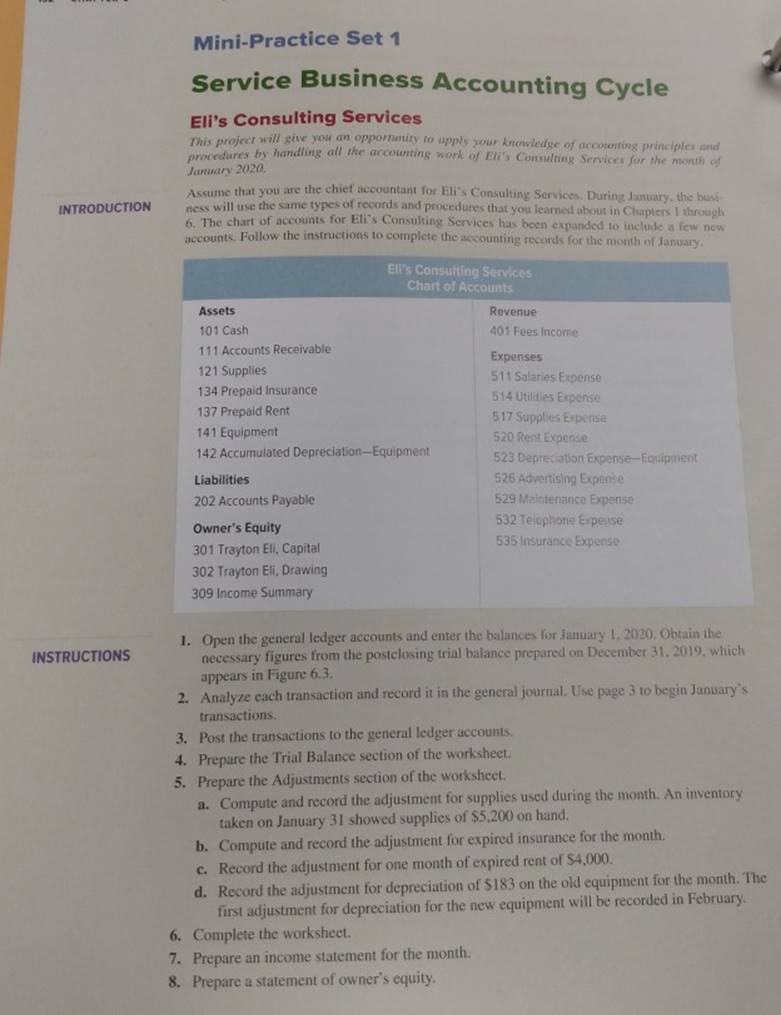

Decoding Accounting Mini Practice Set 1

Let’s delve into the typical structure of Accounting Mini Practice Set 1. Generally, it involves a series of transactions related to a small business. These transactions are presented in a chronological order. Your task is to analyze each transaction, identify the accounts affected, and record the corresponding journal entry.

The Step-by-Step Approach

Here’s a systematic approach to tackling Accounting Mini Practice Set 1:

- Understand the Transaction: Carefully read each transaction, noting the key parties involved, the nature of the transaction, and the date.

- Identify the Accounts: Determine which accounts are affected by the transaction. This involves understanding the debit and credit rules related to each account. For instance, when you purchase supplies on credit, your accounts payable (credit) and supplies (debit) accounts are impacted.

- Record the Journal Entry: Create a journal entry using the debit and credit balances of the affected accounts. Remember, the total debits must equal the total credits.

- Post to the Ledger: After recording each journal entry, transfer the information to the appropriate general ledger accounts.

- Prepare Trial Balance: Construct a trial balance to ensure that the total debits equal the total credits. This is a crucial step in verifying the accuracy of your journal entries.

- Construct Financial Statements: Use the information from the trial balance to prepare the income statement, balance sheet, and statement of cash flows.

Image: www.studocu.com

Common Challenges and Solutions

While working through Accounting Mini Practice Set 1, you might encounter common hurdles. Here are some that I’ve encountered and how to overcome them:

- Confusion with Debit and Credit: Many struggle to grasp the difference between debits and credits. Remember the mnemonic “DEAD” for debits – Debits increase Expenses, Assets, and Dividends, while CRedits increase Revenues, Capital, and Retained Earnings.

- Identifying Correct Accounts: Sometimes determining the specific account to use can be perplexing. Pay close attention to the transaction details, using the chart of accounts to guide your choices.

- Balancing Journal Entries: Ensuring that the debits equal the credits in every journal entry is critical. Carefully review each entry to ensure accuracy and balance.

- Preparing Financial Statements: Creating the financial statements can seem daunting. Start with the basic formula for each:

- Income Statement: Revenue – Expenses = Net Income

- Balance Sheet: Assets = Liabilities + Equity

- Statement of Cash Flows: Cash Inflows – Cash Outflows = Net Change in Cash

Tips and Expert Advice

Learning accounting is a journey; it requires consistent effort and practice. Here’s expert advice to streamline your learning process:

- Take your time. Rushing through practice sets can lead to mistakes. Read each transaction carefully, analyze the accounts affected, and meticulously record the journal entries.

- Use the Chart of Accounts: The chart of accounts is your guide to understanding the different types of accounts in a business. Refer to it often to ensure you’re selecting the correct accounts for each transaction.

- Practice, Practice, Practice: The more practice sets you complete, the more comfortable you’ll become with the concepts. Don’t be afraid to revisit problems and work through them again until you understand them fully.

- Seek Help: If you get stuck on a specific concept, don’t hesitate to ask for help from your instructor, a classmate, or a tutor. There’s no shame in seeking guidance when needed.

- Utilize Online Resources: There are numerous online resources available, including tutorial videos, practice questions, and even completed solutions. Embrace these resources to enhance your understanding and reinforce your learning.

These tips, along with meticulous attention to detail and consistent practice, will help you progress confidently through your accounting studies. Remember, the journey to mastering accounting starts with these foundational practice sets.

FAQs

Here are some frequently asked questions about Accounting Mini Practice Set 1:

Q: Why are practice sets important for learning accounting?

A: Practice sets are designed to bridge the gap between theoretical knowledge and practical application. They allow you to actively work through real-world scenarios, solidifying your understanding of accounting concepts.

Q: How do I know if I’m doing the journal entries and financial statements correctly?

A: It’s always a good idea to double-check your work. Ensure that the debits equal the credits in your journal entries, and verify that the balances on your trial balance match with the amounts used in your financial statements.

Q: What should I do if I get stuck on a question?

A: Don’t be afraid to seek help! Talk to your instructor, classmates, or use online resources to clarify any confusion.

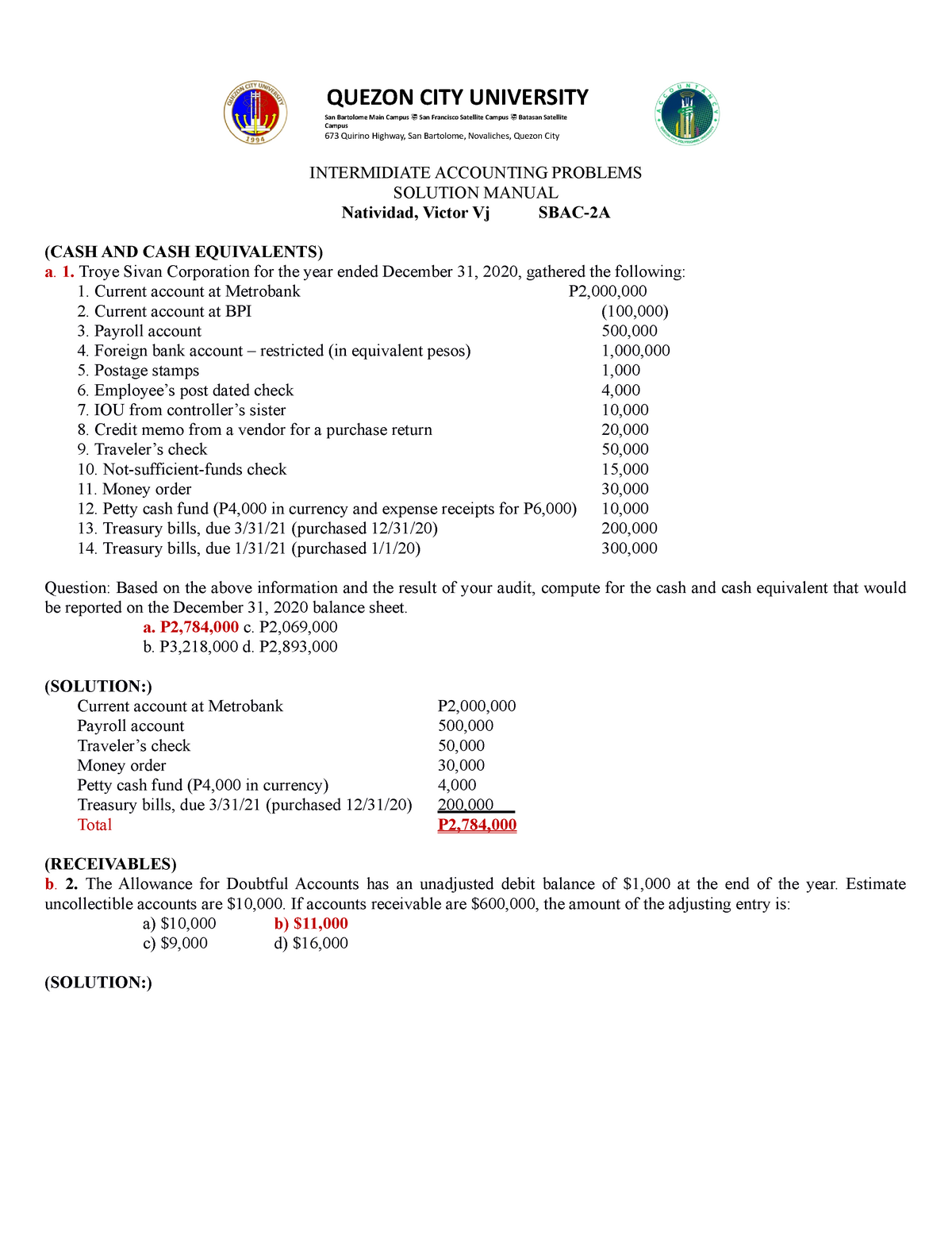

Accounting Mini Practice Set 1 Answers

Conclusion

Mastering Accounting Mini Practice Set 1 is a crucial stepping stone for aspiring accountants. By understanding the fundamental concepts, practicing diligently, and utilizing available resources, you’ll gain the confidence to tackle more complex accounting challenges in the future. Remember, the key lies in consistent effort and a commitment to learning. So, are you ready to dive into the world of accounting and conquer Accounting Mini Practice Set 1? Let me know in the comments below!