Imagine this: You’re excited about a new purchase, swipe your debit card, and head home. Days later, you check your account balance, only to find a dreaded message: “Insufficient funds.” A wave of panic washes over you, and you’re left scrambling to cover the shortfall. This common scenario underscores the importance of a fundamental financial skill: balancing your checking account.

Image: www.chegg.com

Balancing your checking account is like navigating a map to your financial well-being. It’s the process of tracking your income, expenses, and deposits to ensure your account reflects your actual financial position. This isn’t just a chore; it’s a vital tool for staying in control of your finances, avoiding overdrafts, and ultimately, achieving your financial goals. Whether you’re starting out on your financial journey or looking to tighten your grip on your money, understanding how to balance your checking account is a crucial step.

A Deeper Dive: Understanding the Essentials of Checking Account Balancing

The act of balancing your checking account may appear simple, but it requires a systematic approach. It boils down to two core concepts:

Reconciliation: Bridging the Gap Between Your Records and the Bank’s

The first crucial step is reconciliation – the process of matching your personal record of transactions with the bank’s statement. This seemingly meticulous task is crucial for uncovering discrepancies and ensuring your records reflect the reality of your account.

To effectively reconcile your account, you’ll need:

- Your bank statement: This official document outlines your account’s transactions, including deposits, withdrawals, and any fees.

- Your check register or online banking records: This is your personal record of transactions, often maintained in a physical checkbook or digitally through online banking services.

The reconciliation process involves comparing these two sources, noting any discrepancies and adjusting your records accordingly. It’s like playing detective, tracing the flow of your money and ensuring every transaction finds its place.

The Power of Spreadsheets: Organizing your Finances

While basic check registers and online banking platforms are useful, some prefer a more structured approach. Spreadsheets emerge as valuable allies in this process, providing a customizable platform to track your financial activities.

Here’s how spreadsheets can empower your financial management:

- Clear overview: Spreadsheets provide a comprehensive view of your account activities, allowing you to quickly identify patterns or trends in your spending habits.

- Categorization: Organize your spending by category – groceries, entertainment, transportation, and more – to gain valuable insight into where your money goes.

- Goal tracking: Set up budget categories aligned with your financial goals, such as saving for a down payment or a dream vacation.

By leveraging spreadsheets, you gain greater command over your finances, turning seemingly mundane transactions into data points that paint a clearer picture of your financial well-being.

Image: www.chegg.com

Beyond the Basics: Exploring Advanced Balancing Techniques

Balancing your checking account is not confined to the traditional methods. Several advanced techniques can elevate your financial management, empowering you to take control:

Embrace the Digital Era: Online Banking and Mobile Apps

Technology has revolutionized banking, making balancing your checking account more convenient and efficient than ever before. Online banking and mobile apps provide real-time access to your account information, allowing you to instantly track transactions, monitor your balance, and even make transfers with just a few clicks.

Automatic Reconciliation: Streamlining the Process

Many online banking platforms have integrated automatic reconciliation features, eliminating the need for manual comparison between your records and the bank statement. This automated process streamlines the balancing process, saving you time and reducing the risk of human errors.

Budgets, Budgets, Budgets: Building a Road Map to Financial Success

The act of balancing your checking account goes hand-in-hand with effective budgeting. By creating a budget, you establish a plan for your income and expenses, allowing you to allocate your money strategically toward achieving your financial goals.

Building a budget involves:

- Income assessment: Determine your regular income sources and their frequency.

- Expense tracking: Analyze your spending patterns, identifying both essential and discretionary expenses.

- Setting financial goals: Establish clear, measurable financial goals that provide direction for your budget.

A well-structured budget acts as a road map, guiding your financial decisions and ensuring you stay on track toward your financial objectives.

Expert Insights and Actionable Tips to Enhance Your Financial Prowess

While balancing your checking account is essential, it’s just one piece of the financial puzzle. To truly master your finances, consider these expert-backed insights:

The Power of 50/30/20: A Simple Budgeting Framework

Financial experts often recommend the 50/30/20 budgeting rule:

- 50% for Needs: Allocate 50% of your income to essential expenses like housing, utilities, groceries, and transportation.

- 30% for Wants: The remaining 30% can be dedicated to discretionary expenses like entertainment, hobbies, and dining out.

- 20% for Financial Goals: Prioritize saving and investing by allocating 20% of your income toward building your financial security and achieving your dreams, be it retirement planning or paying off debt.

Track Your Spending Like a Pro

Developing a habit of tracking your expenses, even relatively small purchases, can unveil valuable insights into your spending patterns. This awareness allows you to identify areas for potential savings and make informed financial decisions.

Keep it Simple, Keep it Effective

While sophisticated financial management tools can be helpful, don’t overcomplicate the process. Start with a simple checking account balance method and gradually incorporate additional tools and techniques as you gain confidence and experience.

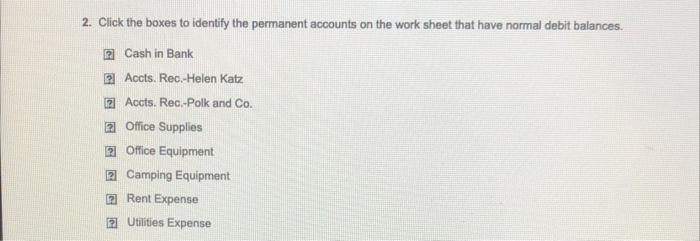

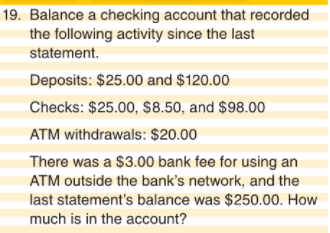

Balancing Your Checking Account Chapter 8 Lesson 4

Conclusion: Taking Charge of Your Financial Future

Balancing your checking account is more than just a routine task; it’s a habit that empowers you to take control of your finances. By understanding the process, embracing technology, and developing a consistent budgeting approach, you can navigate your financial journey with confidence and achieve your financial goals. Whether you’re starting out or looking to refine your financial strategies, mastering this fundamental skill is a crucial step toward a more secure and prosperous future.