Imagine this: You entrusted your hard-earned savings to a trustee, someone you believed would safeguard your financial future. Time passes, and a nagging sense of unease sets in. You start to wonder: “How is my money being managed? Are my investments performing as expected?” This is where the need for an accounting from your trustee arises. A proper accounting provides transparency, allowing you to understand the status of your funds and whether your trustee is acting in your best interest.

Image: www.aldavlaw.com

This guide will walk you through the process of requesting an accounting from your trustee. We will explore the importance of clear communication, the essential elements of a compelling request letter, and the legal recourse available if your requests are ignored.

Understanding the Importance of an Accounting

A trustee owes a fiduciary duty to the beneficiaries, meaning they must act in the beneficiaries’ best interests. Transparency is an integral part of this duty; a comprehensive accounting allows you to:

- Monitor the Performance of Your Investments: An accounting provides insights into your investment portfolio’s performance, revealing the growth, losses, and strategies employed by the trustee.

- Assess the Trustee’s Fees and Expenses: Trustees may charge fees for their services. An accounting clarifies the fees associated with managing your assets and any other expenses incurred.

- Ensure Legal Compliance: Tax rules and regulations may apply to trusts. An accounting helps you confirm that your trustee is following all applicable laws.

- Identify Conflicts of Interest: If the accounting reveals that the trustee is benefiting personally from your assets or engaging in questionable practices, you might need to take action.

How to Write a Letter Requesting an Accounting

Crafting a formal letter requesting an accounting is the first step towards gaining transparency. Your letter should be polite but firm, clearly stating your request and outlining the information you require.

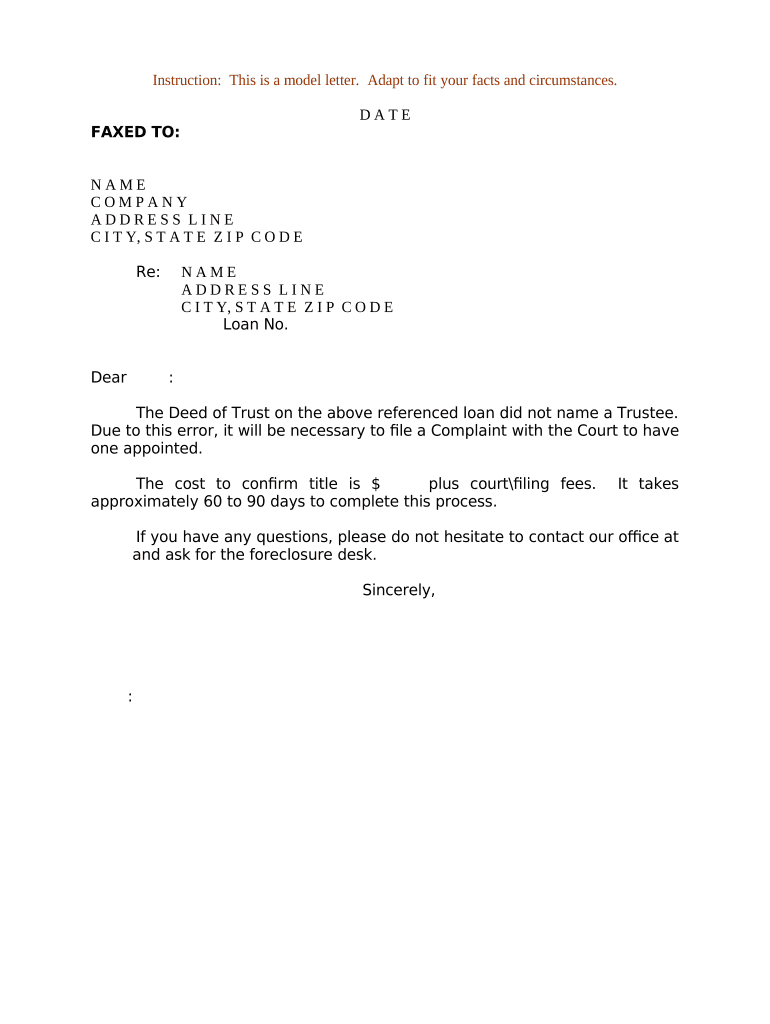

Here’s a sample letter:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Name of Trustee]

[Address of Trustee]

Dear [Name of Trustee],

This letter is to formally request an accounting of the [Name of Trust] trust. I am a beneficiary of this trust and am entitled to regular and accurate updates regarding the management and performance of my assets held within the trust.

I kindly request that you provide me with a detailed accounting that includes:

- A complete list of all assets held within the trust: This should include descriptions, current values, and any changes in asset holdings since the last accounting.

- A detailed statement of all income and expenses: This should include the dates of all transactions, the nature of the transaction, and supporting documentation where applicable.

- A breakdown of all fees and commissions charged by you or any associated agencies for the management of the trust.

- Details of any transactions that deviate from the original trust document’s provisions: If there has been a change in investment strategy or a significant deviation from the terms outlined in the trust agreement, I would like a detailed explanation for these actions.

I request that you provide me with this accounting within [Number] days of receiving this letter. I am available to meet with you at your convenience to discuss the information further.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

What if Your Request is Ignored?

Unfortunately, in some cases, your trustee may ignore your requests for an accounting. This could be a sign that something is amiss. Should this occur, you have several options:

- Seek Legal Advice: Consult with a qualified attorney who specializes in trust law. They can assess your rights and guide you on appropriate legal action.

- File a Petition with the Court: If your trustee continues to deny your requests for an accounting, you may need to file a formal petition with the court overseeing the trust. This will require legal representation and can be a more involved process.

Image: www.signnow.com

Key Legal Considerations

Understanding your legal rights when dealing with a trustee is crucial.

The following points are essential:

- Right to Information: As a beneficiary, you generally have the right to receive regular and accurate information about your assets held in the trust.

- Right to an Accounting: Beneficiaries have the right to an accounting of the trust’s assets, income, expenses, and management, particularly if there is a reason to believe the trust is not being properly managed.

- Statutory Requirements: Many states have specific statutes that define the rights of beneficiaries and the duties of trustees. Your attorney can guide you on the rules specific to your state.

- Limitations on Access: The trust document itself may specify certain limitations on beneficiary access to information. An attorney can interpret these provisions in your best interest.

Sample Letter To Trustee Requesting Accounting

Protecting Your Financial Future

Requesting an accounting from your trustee can be a valuable step in protecting your financial future. By understanding your rights and ensuring transparency in the management of your assets, you can have peace of mind knowing your interests are being upheld.

Remember that seeking legal advice is always recommended if you encounter resistance from the trustee or have questions about your rights. You deserve clear communication and access to information about your assets. Take control of your financial future by demanding transparency and accountability from your trustee.