Have you ever wondered how large retailers like Amazon or Walmart keep track of their millions of products, their sales, and their expenses? They rely on a powerful tool called a chart of accounts. Imagine a meticulously organized system that holds the key to understanding your business’s financial health. This is what a chart of accounts does for any merchandising business – it’s the backbone of accurate financial reporting.

Image: gudangmateri.github.io

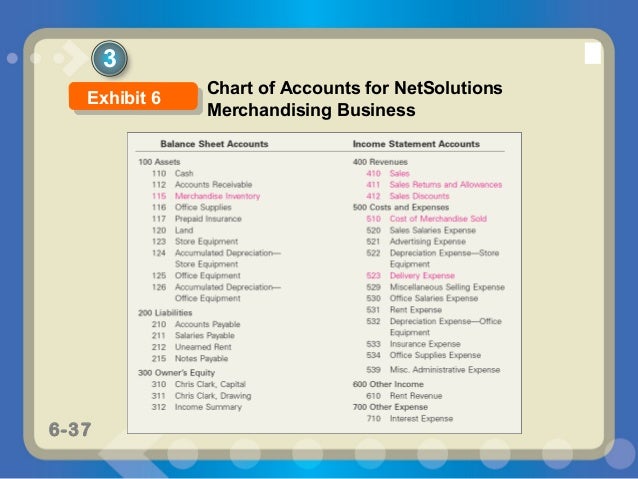

A chart of accounts is a detailed list of every possible account a business might need to track its financial transactions. It’s more than just a list; it’s a standardized framework that brings order to the chaos of money flowing in and out of your business. This article will dive into the specific needs of a merchandising business, illustrating how a well-structured chart of accounts becomes the cornerstone of efficient financial management.

Understanding the Foundation: A Comprehensive Overview

Think of a chart of accounts as a library for your business’s financial data. It’s organized by categories, representing different aspects of your financial activity. The most common categories include:

- Assets: Things your business owns, like cash, inventory, buildings, and equipment.

- Liabilities: Obligations your business owes to others, such as loans, accounts payable, and accrued expenses.

- Equity: The owners’ stake in the business, including capital contributions and retained earnings.

- Revenue: Money earned from selling products or providing services.

- Expenses: Costs incurred in running the business, such as rent, salaries, and advertising.

Within each category, you define specific accounts. For instance, under “Assets,” you might have accounts like “Cash in Bank,” “Accounts Receivable,” and “Inventory.” These accounts are organized in a hierarchical structure, making it easier to track and analyze data.

Chart of Accounts for a Merchandising Business: Tailored for Success

While the basic categories remain consistent, a chart of accounts for a merchandising business has specific needs. Let’s break down the crucial accounts you’ll need:

Asset Accounts

- Cash and Cash Equivalents: Tracks your liquid assets like cash in bank accounts, petty cash, and short-term investments.

- Accounts Receivable: Keeps tabs on money owed to you by customers (including trade credit).

- Inventory: This is a crucial account for merchandising businesses! It represents the value of the goods you have available for sale. You need to keep track of:

- Raw Materials (if you’re manufacturing)

- Work in Progress (if you’re manufacturing)

- Finished Goods (ready for sale)

- Inventory Reserves: Often, an account to represent potential obsolescence or damage.

- Fixed Assets: This includes the tangible assets that are expected to last for more than a year and are used in your operations, like furniture, fixtures, equipment, and buildings.

- Investments: Includes stocks, bonds, and other assets you hold for investment purposes.

Image: childhealthpolicy.vumc.org

Liability Accounts

- Accounts Payable: The money your business owes to suppliers and vendors.

- Short-Term Notes Payable: Short-term loans or obligations (usually less than a year).

- Long-Term Notes Payable: Long-term loans or obligations (more than a year).

- Accrued Expenses: Expenses incurred but not yet paid (such as wages or utilities).

- Deferred Revenue: This represents money received from customers, but the service or product hasn’t been delivered yet.

Equity Accounts

- Owner’s Equity: Represents the owner’s initial investment and any subsequent contributions or withdrawals.

- Retained Earnings: This is the accumulated profit that’s been retained in the business from previous years, which is available for reinvestment or distribution as dividends.

Revenue and Expense Accounts

- Sales Revenue: Tracks the total amount of revenue your business generates from sales of goods.

- Cost of Goods Sold (COGS): A critical account for merchandising businesses, COGS represents the direct costs associated with producing or obtaining the goods you sell. This includes:

- Purchase Costs of Inventory

- Incoming Freight

- Direct Labor (if manufacturing)

- Operating Expenses: Covers the various expenses involved in running your business, including:

- Rent

- Salaries

- Utilities

- Advertising

- Sales & Marketing

- General & Administrative Expenses

- Interest Expense: The cost of borrowing money.

- Income Taxes: Taxes paid on your net income.

Unique Considerations for Merchandising Businesses

- Sales Returns and Allowances: Handling customer returns and allowances.

- Sales Discounts: This account tracks discounts given to customers for early payment or volume purchases.

- Bad Debt Expense: An estimate of the amount of accounts receivable that your business may not be able to collect.

Strategic Insights: Empowering Your Financial Decisions

Here are some practical tips to maximize your chart of accounts:

- Keep It Simple: While comprehensive, your chart of accounts should be user-friendly. Avoid unnecessary complexities that can hinder your ability to analyze data quickly.

- Use Standardized Chart of Accounts: There are industry-specific chart of accounts available to provide a starting point. This helps you align your financial reporting with industry norms and makes it easier to compare your performance.

- Regularly Review: Financial needs change! As your business grows, your chart of accounts must evolve along with it. Review your accounts and make updates as required.

A Chart Of Accounts For A Merchandising Business

Conclusion: Charting a Course for Success

Having a well-structured chart of accounts is no longer just good practice – it’s crucial for a merchandising business’s growth. It provides a framework for organizing your financial data, allowing you to track key metrics like profitability, inventory turnover, and sales trends. With the power of a chart of accounts, you can make informed decisions, optimize your business operations, and chart a course towards lasting financial success. So, get started today and unlock the potential of your own merchandising empire!